WHAT IS REVOLUT?

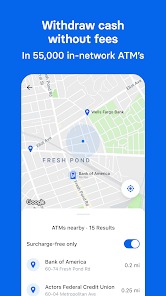

A prepaid debit card from Revolut may be used for chip, contactless, and internet purchases as well as ATM withdrawals both domestically and internationally.

Revolut doesn’t have a branch as a conventional bank does. Instead, you may complete all of your transactions online using the Revolut app on your phone.

You may establish an account and obtain a card for use while making purchases. You can choose between receiving a real card in the mail and a virtual card on your phone, or you can receive both.

Additionally, you may save money, purchase and sell stocks, and send money abroad.

Revolut also includes tools that allow you to track your spending and create savings objectives.

To view all of your spending insights, not just those related to purchases made with your Revolut card, you may link any bank accounts you may have through the app.

Revolut has no physical presence, therefore it is evident that you cannot deposit cash or register checks at your local bank. However, you may have salaries deposited into your account because it comes with BIC and IBAN numbers.

When you spend money at specific merchants and use your Revolut card to make the purchase, you can also receive cashback.

HOW DOES THE REVOLUT APP WORK?

In case that you have an iPhone, you can download the app from the Apple App Store; if you own an Android phone, you can download it from the Google Play Store.

Once you have the app, you set up your account by following the on-screen directions.

You must enter some facts, like your name, address, date of birth, and contact information.

The app will also require you to take a picture of your passport or other kind of photo identification to prove your identity.

Additionally, you will be prompted to create an access security passcode that you must input each time you use the app.

When everything is operating smoothly, you can add money to your account via bank transfer.

You have the option of immediately using a virtual card on your phone or waiting for your actual card to arrive in the mail.

Additionally, you may arrange for your pay to be deposited directly into your Revolut account.

You may also make advantage of the other capabilities, such as transferring money abroad.

WHY DO PEOPLE CHOOSE REVOLUT?

When compared to today’s scant or unsafe digital options from the majority of banks, the app is rather useful and interesting.

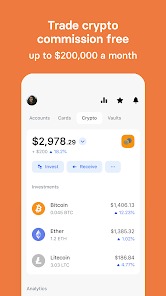

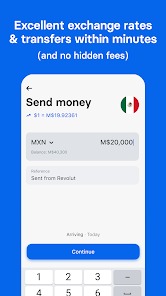

Revolut’s exchange option is extremely tempting since you can convert your euros for more than 150 other foreign currencies as well as Bitcoin, Ripple, Ethereum, Litecoin, and XRP at favorable exchange rates and without paying a fee.

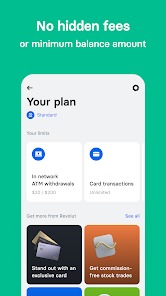

The regular account is free, save for the initial €6 card fee, so there are no minimum deposits or maintenance costs. However, if you don’t mind spending a little more, you might choose to obtain the €7.99 premium account or the €13.99 metal account instead.

There won’t be any annoying extra fees if you take money from an ATM when traveling or over the border because ATM withdrawals are often free both domestically and internationally.

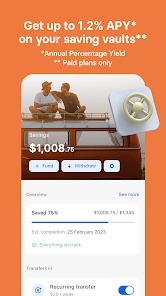

The expenditure tracking function may reduce anxiety in daily life if you tend to spend mindlessly and dread checking your online banking, and the saving vaults are brilliant.