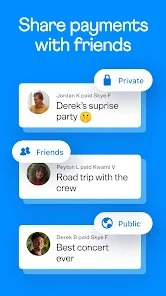

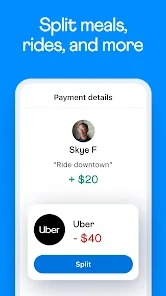

American mobile payment company Venmo was founded in 2009 and has been owned by PayPal since 2012. Previously, Venmo was intended for friends and family who wanted to split costs for things like movie tickets, supper, rent, sporting event tickets, etc. Account holders can transfer money to others using a mobile phone app, but both the sender and the recipient must be present in the US. The company processed $230 billion worth of transactions in 2021, bringing in $850 million.

Researchers have shown that Venmo’s default setting of publishing every peer-to-peer transaction (but not the amount) exposes sensitive information about users’ lives in specific circumstances. The company reached a settlement with the Federal Trade Commission in 2018 about multiple privacy and security violations related to this and other services, and the corresponding settings have since been changed. Venmo, though, persisted in drawing flak for subjecting users to real privacy dangers.

Venmo is the fast, safe, social way to pay and get paid. Join over 83 million people who use the Venmo app today.

APP FEATURES OF VENMO

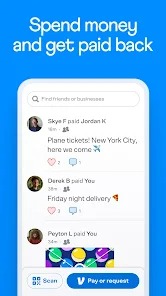

*SEND AND RECEIVE MONEY*

Receive and Send money

- Pay and receive money from everything

- Easy sending money and receive

Earn credit card points from Venmo

- Cash back 3% of spending category

- Shop everything with Visa card and get money back

Pay with Venmo in stores

- Scan and Go

- Use QR codes to pay

User reviews

“I’ve been a Venmo person for a few years now and this is a finance app that does it right. I’ve cherished seeing this business enterprise advance and enlarge their reach. It’s the exceptional way to ship money between friends, and with the new update, the total lot is so except subject laid out internal interface! You can inform they care about their clients through how dedicated they are to every instructing and making price range barring concern reachable for all. I use their financial savings card and it is besides situation one of my desired savings taking part in playing cards I have. Your purchases are obviously laid out for you and mechanically analyzed so you can see what instructions you’re spending the most in. They have 3% cash decrease returned on the type I use the most, 2% on the 2nd most used and 1% on the complete lot else? It’s a no-brainer! I can use the cash that are despatched to my by way of skill of buddies to pay off my steadiness or I can swap these money to the monetary group of my figuring out on for free. I sincerely ordered their debit card. –

Annie.E” – ★★★★★

“Venmo is the first region to clearly approve me for an unsecured financial savings card! Now I’ve been succesful to get a couple of others! It’s awesome handy to decide out how to use it! From sending money, receiving money to paying for a purchase! I love how ordinary it is to pay on your credit card also! And it opinions to the financial savings bureaus particularly a lot daily! So if you stop up racking it up, make fine to pay a little on it proper right here and there or to at least pay the minimal due with the resource of the due date and then your ranking will go up! I wouldn’t truly max it out even though till you sketch on paying on it authentic soon! –

Quin.A” – ★★★★★